How Real Estate Investment in Nigeria Transformed My Life (And How You Can Start in 2025)

Most people hustle to survive. I almost did, too, until real estate changed everything. I wasn’t rich; I was just a broke student with a barbershop hustle.

One smart land deal flipped my story. Here’s how real estate can transform your financial future, too.

How I Built Wealth and Stability Through Real Estate (And How You Can Too in 2025)

Feeling stuck in the daily grind? I was, too, until a ₦500K land gamble flipped my financial world. Could you stick with me? As I walk you through my story.

Real estate has been a transformative force in my life, allowing me to live the life of my dreams. It wasn't an instant change, but a gradual one that led to a more fulfilling life, which I now enjoy.

I never thought of it as a safe escape from the everyday struggles I used to face.

But through a steady and calculated investment in overlooked areas of property, I scaled from nothing to a brilliant view of a bright future, just at the point when uncertainty overwhelmed my thoughts.

Table of Contents:

My ₦500K Investment Story

Why Real Estate Is Smart in 2025

Mindset Shift: From Saving to Building Wealth-The Key to Your Financial Freedom

My Multiple Income Streams

How to Start With Little or No Capital

5 Steps to Start Building Wealth

Mistakes to Avoid

Long-Term Thinking in Real Estate

Nigeria vs. Abroad

Final Thoughts + Free Checklist

My 'Aha!' Moment: ₦500k Land Investment That Changed Everything (Nigerian Real Estate)

In my final year of school, I was fully immersed in my barbershop hustle. I’d saved about ₦500,000, which felt like a big deal back then.

Around September, someone mentioned a couple of cheap plots in a low-key area out of town. I wasn’t thinking like an investor.

I just figured, "Let me park this money somewhere before I spend it on something random." So, I went ahead and grabbed two plots at ₦ 250,000 each: no deep analysis, no big expectations.

Fast forward to April the following year, boom!.

That quiet area suddenly started making noise. A mall, a new market, a government hospital, even major real estate companies turned up. It was like the place had flipped overnight.

By May, each plot was worth ₦1.3 million, totaling ₦2.6 million.

I had just made over 400% return without lifting a finger.

That was my lightbulb moment.

I realized then: this is how wealth is built. Not always loud or flashy, just staying ready, spotting overlooked value, and making your move when others aren’t watching.

Ever since that day, I haven’t looked back. Real estate became my pattern, and my wealth started to grow steadily, bit by bit, as I continued to make successful investments.

In this article, I'll guide you through my adventurous journey and the various practical approaches, such as identifying undervalued properties, understanding market trends, and leveraging financing options, that have led me to where I am today.

I'll also show you how easy it could be for you if real estate is what you've chosen to start building wealth in 2025, regardless of your starting capital.

Why Real Estate Is Still a Smart Investment in 2025

Regardless of economic fluctuations and the rapid pace of digital evolution, real estate has proven to be one of the most powerful, tried, and tested wealth-building tools of all time.

The prices of properties continue to rise in high-brow areas.

Land has remained a scarce resource, driving its value up due to its limited availability.

Rental income has become a steady source of cash flow.

Real estate helps protect against inflation, as its value tends to rise in line with the cost of living.

“Every person who invests in well-selected real estate in a growing section of a prosperous community adopts the surest and safest method of becoming independent, for real estate is the basis of wealth.” — Theodore Roosevelt.

Even if real estate isn’t your primary hustle, it can still be your most brilliant financial move. Here’s why many modern entrepreneurs are quietly shifting their wealth strategies toward real estate.

The Mindset Shift That Changed Everything

Before trying out real estate, I only chased income. My venturing into it gave me clarity about building assets.

The shift from saving to investing, from quick wins to long-term value, is what truly transformed my life.

I mean, all along, I thought I was going to hit my financial goals and live financially free simply by saving as much as I earned.

I never really thought of sowing long-term seeds until I took the first step and realized the goldmine I had been missing out on all along.

How Real Estate Helped Me Build Multiple Income Streams

After my first earnings from the land sales, the income continued to flow because I explored other aspects that were equally profitable and generated real-time returns.

Flipping opportunities: Buying a house, fixing it up, and waiting for its value to rise, then selling it for more money

Land banking: This involves buying and holding land for a period until the area becomes popular, thereby selling at an increased value.

Referrals and commissions: Helping others buy or sell a property and getting paid a certain percentage of the deal.

Real estate advisory: Offering paid, wise investment advice on where to buy, sell, or invest, saving them from investment mistakes.

Want My Proven Land-Buying Checklist (2025 Edition)?

Avoid costly mistakes and invest with confidence.

5 Practical Steps to Start Building Wealth Through Real Estate in 2025

1. Start With Education, Not Emotion:

Generally, before starting any investment, you first need to study and learn about the market surrounding it.

Understand basic concepts such as land documentation, land topography and location, land size and measurements, and other relevant factors.

Knowing these will give you an advantage in investing.

2. Make Use Of What You Have: Time, Knowledge, or Network

If you don't have the required capital to start, you can use your time instead.

You can learn the ropes and offer value based on the knowledge gained over time.

It would surprise you how many deals and connections could come from sharing such valuable insight.

3. Consider Land and Off-Plan Property Options

Choose between buying undeveloped land for future use or investing early in a property that’s still being built, often at a lower price.

This allows you to enter the market when the stakes are low and then exit with a high profit margin.

4. Master the Art of Negotiation

The price is never final. Never fear to negotiate, but learn never to negotiate out of fear. These are business habits that can save you a significant amount.

5. Build Trust, Visibility, and Credibility in the Market

Trust is one of the pillars of success in any business, real estate not being an exception.

It gives you a voice and will eventually bring you into bigger rooms. Having credibility in the market means gaining vast opportunities in the long run.

How to Choose the Right Location for Your First Investment

"Where you buy determines what you gain.” goes far beyond a catchy saying; it’s a wealth principle.

Go where people are moving to, not just where they already are. The aim should be to “Buy real estate in areas where the path exists, and buy more real estate where there is no path, but you can create your own.” — David Waronker.

Be on the lookout for profitable upcoming government projects or infrastructure investments that could benefit your financial goals.

Pay more attention to accessibility, security, and the property's land title history when considering any purchase.

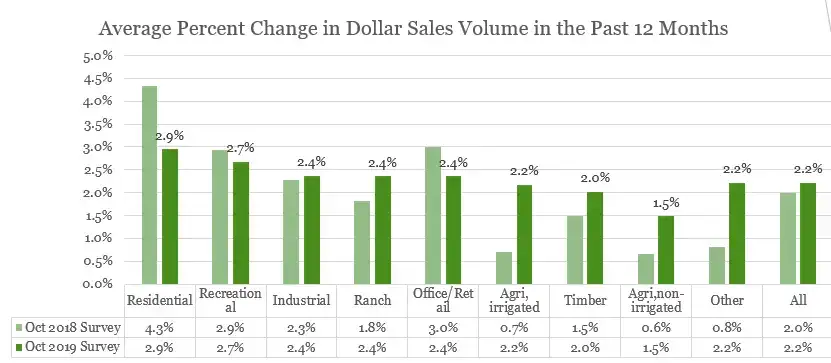

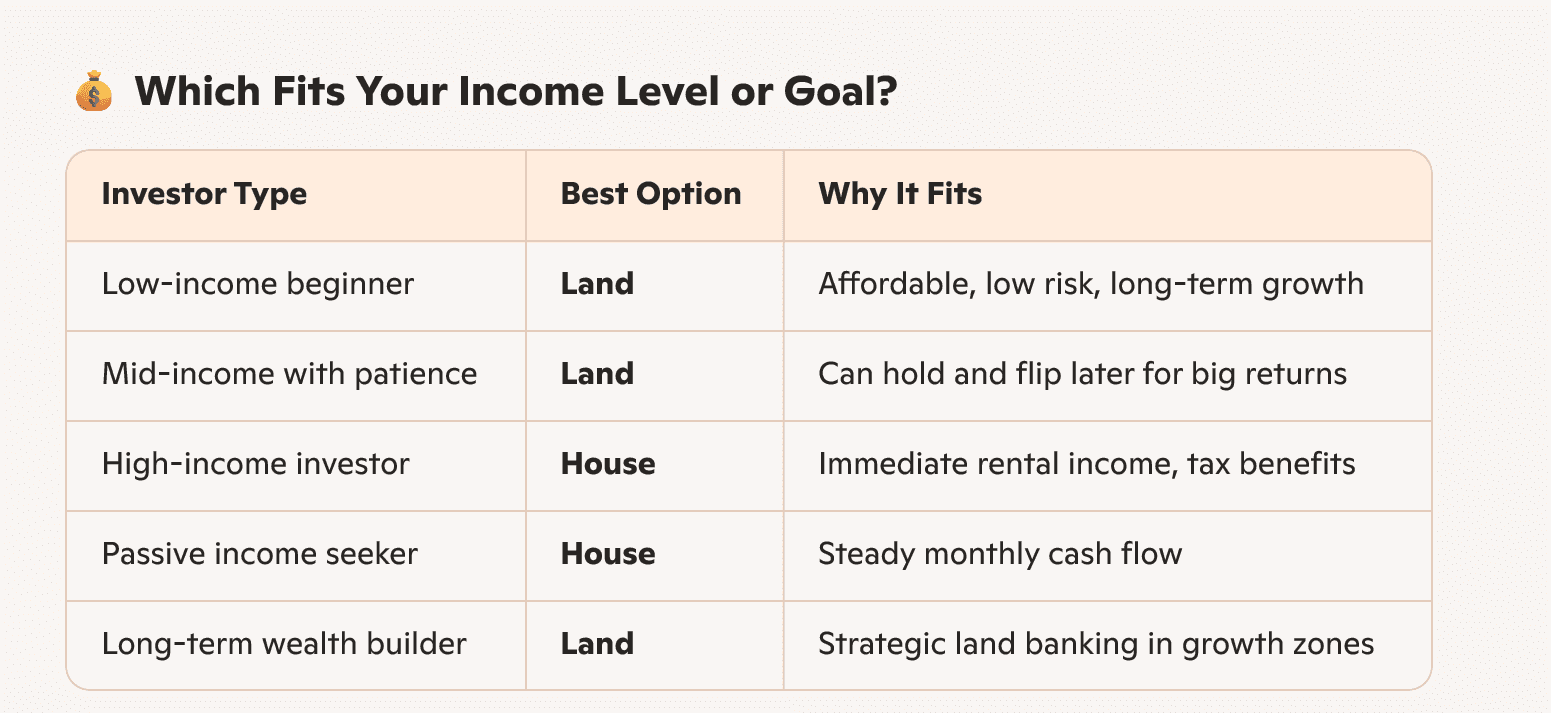

Land vs. Houses: Which One Should You Buy First?

Although built houses in high-brow areas provide quicker rental income, they cost more.

As someone starting in real estate, consider buying land.

They are cheaper and suitable for long-term investments. With time, you can diversify and invest on both ends when you have built enough capital.

The table below should guide you on where to invest.

How to Start Real Estate with Little or No Capital:

Yes, it’s possible. Here’s how:

Partner with someone who has the money but no time. You can both give what you have as a means to a profitable end for both of you.

Become a real estate agent and gain industry knowledge while earning a living.

Become a member of any co-operative investment group.

Offer digital marketing or sales assistance to real estate companies in exchange for a percentage of their sales commissions.

Mistakes I Made in Real Estate (So You Don’t Have To)

We all have our losses in business, stemming from bad to hasty decisions.

I have surely had my fair share of these, and they cost me a lot, but brought me key lessons which I will share with you to save you from the same path.

Here’s what to avoid:

Rushing into hasty decision-making without proper information about the property.

Failing to pay required attention to land titles and documents.

Making the big mistake of not booking to see the property before making payment.

Refusing to dig into hidden costs that come with the purchase.

The Power of Long-Term Thinking in Real Estate

If you’re looking to get rich overnight, real estate isn’t your game. But if you want to build sustainable wealth:

Start small

Stay consistent

Think in decades, not days.

Nigeria Real Estate vs. Real Estate Abroad: What's Best for You?

Both have their pros and cons:

Nigeria: Easier access, faster appreciation, fewer taxes

Abroad: More stable systems, mortgage options, legal protections

Start with what’s within your reach. The key is to start.

Why Now Is the Best Time to Get into Real Estate.

No new land is produced; land is becoming increasingly scarce.

Where to live will always be a quest for people; solving that need puts you at a financial advantage.

Information is readily available about any property.

Real estate investment is now more accessible than ever to everyone, even on your phone.

It builds generational wealth.

Final Thoughts: Start Small, Stay Consistent, Think Long-Term.

Real estate does not require you to break the bank to start investing, no!

All you need is a plan, a little patience, and the desire to learn and grow with time.

The roadmap I have shared is the exact blueprint I used to achieve financial freedom through real estate.

You can apply it and in a few years, you’ll look back and be glad you took that first step.

Want to Start Your Real Estate Journey?

Real estate changed my life, now I want it to change yours.

I’ve put together a free guide that breaks down everything I wish I had known when I started, including how to find high-growth areas, avoid costly mistakes, and get started with little capital.

Want to avoid costly beginner mistakes?

Download my FREE Land-Buying Checklist (2025 Edition) and invest smart from day one.

You'll also get:

Exclusive real estate tips

Investment opportunities before they go public

Behind-the-scenes updates from my journey

Let 2025 be the year you stop watching others build wealth and start building yours.

Have you ever considered investing in land? Could you share your thoughts in the comments below?